Public Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Proprietary Mobile app

- Not provided

- Provides the ability to publicly trade and view investment portfolios and completed trades of other clients

Our Evaluation of Public

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Public is a broker with higher-than-average risk and the TU Overall Score of 4.45 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Public clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

The Public brokerage targets clients with no investment experience and gives them the opportunity to learn from successful traders.

Brief Look at Public

Public is a brokerage company that provides stock market services for public trading and investment. Public offers a wide range of financial instruments that include stocks and ETFs. The broker provides its clients with a convenient and easy-to-use mobile application with public access to completed trades. The security of cooperation is guaranteed by a license issued by the Financial Industry Regulatory Authority (FINRA, CRD#: 136352/SEC#: 8-67002) and protection by SIPC.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A voluntary tip system has been introduced instead of brokerage commission and payment for order flow.

- There are no requirements for the minimum amount of the deposit.

- The company provides the opportunity to trade fractional shares in the amount of USD 1.

- It is allowed to create an account by minors who can use it to learn to invest in the examples of trading by other clients of the broker.

- For trades, the company offers a simple and convenient proprietary mobile application.

- Public is insured by the SIPC, which means protection and reimbursement of client assets up to $500,000, including up to $250,000 in cash.

- For newcomers to the stock market to gain investment experience, all trades of the company's clients are freely available.

- Public does not offer bonds, futures, or options for trading.

- Custodian, retirement, and savings accounts cannot be opened.

- There is no stationary or web version of the trading terminal.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker provides an opportunity for novice investors to learn how to trade shares and ETFs on the trades of professional traders, which they share in the public.com community. In addition to SIPC insurance, the Apex clearing company through which the broker makes transactions has its own insurance policy from the lead underwriter Lloyd's of London Syndicates.

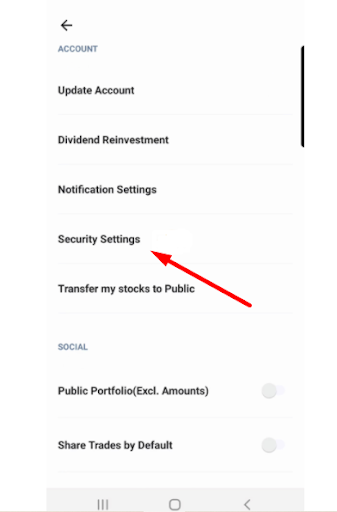

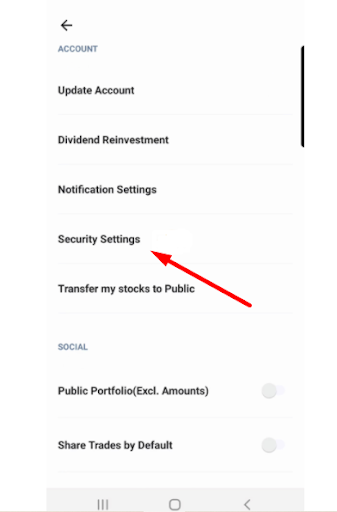

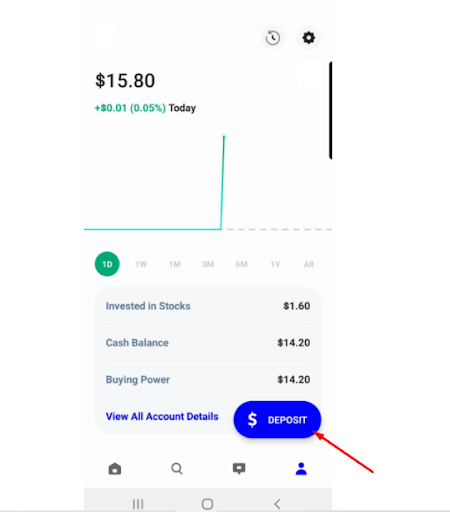

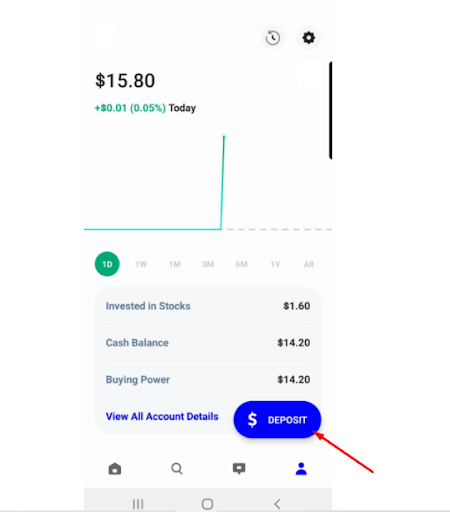

The Public mobile application has an easy-to-use interface, which is designed to perform transactions without preliminary analysis. To ensure the security of customer accounts, 128-bit encryption is used, and TS 1.2 technology is employed to protect data transmission. Logging in to your account is done using two-factor authentication. You can also connect biometric authentication for Android or security lock for device owners with the iOS operating system.

Regardless of the value of the financial instruments offered by the broker, the client can purchase assets for any amount, since it is allowed to buy only a part of a share. According to Public users, the main disadvantage of the site is that trading and managing an account can only be done through a mobile application, which is not designed to carry out high-quality technical analysis.

Public Summary

| 💻 Trading platform: | Proprietary mobile application |

|---|---|

| 📊 Accounts: | Real account |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfer, debit card |

| 🚀 Minimum deposit: | From USD 1 |

| ⚖️ Leverage: | Not provided |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | There are no mandatory trading fees |

| 🔧 Instruments: | Shares, ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Provides the ability to publicly trade and view investment portfolios and completed trades of other clients |

| 🎁 Contests and bonuses: | Yes |

The Public broker specializes in stock and ETF trading, as it focuses on investors with no experience because it believes that other assets for beginners have a high degree of financial risk. For the same reason, it does not include OTC shares in the list of investment instruments. To work on the stock market, Public provides a free mobile application available for download on the Google Play Market and the App Store. Account maintenance and brokerage fees are not charged, but the client, at his discretion, can thank the broker for the trade with a tip.

Public Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

In order to gain access to Public’s personal account, you must become a client of the broker. Applicants must be citizens or permanent residents of the United States, or persons who have a valid visa. To register and open an account you need to:

Download the application on the App Store or Google Play Market (depending on the model of the mobile device).

After that, you need to click the Get the app button and in the form that opens, enter your phone number, which will receive the activation code.

Then you need to fill out the registration form, indicating your personal data, email and a valid social security number. You also need to link a US bank account.

After activating, the following opportunities will be available in the personal account:

Also in the personal account, the trader has access to:

-

Making trades.

-

Detailed transaction history.

-

Formation and viewing of watchlists.

-

Automatic reinvestment connections.

-

Settings for notifications, personal data and the degree of publicity of the account.

-

Referral reward information.

-

Button for communicating with online chat operators.

Regulation and safety

The Public brand is operated by Open to the Public Investing, Inc. It is a subsidiary of Public Holdings, Inc. The broker operates under the supervision of the Financial Services Industry Regulatory Authority (FINRA).

The SIPC insures assets of Public clients up to USD 500,000, and the maximum policy coverage for the balance of funds is USD 250,000. Investor accounts are protected by 2FA authentication and 128-bit encryption, which eliminates the possibility of their personal and payment information being used by unauthorized persons.

Advantages

- Ability to file a complaint with regulatory authorities

- Reliable account protection

- Availability of insurance coverage and additional policy from the clearing company

- Securing data transmission with TLS 1.2

Disadvantages

- Few ways to deposit and withdraw funds

- Funds are not held in third-party segregated bank accounts

- Due to extraordinary security measures, financial instruments are limited to stocks and ETFs

- Verification is a mandatory procedure

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Real account | From $1 | No |

When making trades, small commissions are withheld by FINRA and SIPC, and when depositing or withdrawing funds, additional fees may be applied by the sending bank (recipient).

While learning the trading conditions of public.com, the Traders Union analysts also calculated the average commission for trades. The table contains a zero value since a client can trade for free if, when placing a position, he places “$0” in the tip column.

| Broker | Average commission | Level |

|---|---|---|

|

$1 | |

|

$4 |

Account types

For investing and trading, Public offers an individual brokerage account that does not have tax incentives. Account opening and maintenance are free of charge. There are no requirements for the minimum size of the deposit. You can trade only with your own funds, without using margin.

Account types:

The company does not provide a demo account for trial trading. Only a real account is available, transactions on which are carried out through a mobile application.

There are no tools for professional technical analysis in the application, so Public may not be suitable for experienced traders. The company is targeting novice investors who can gain experience through public trading.

Deposit and withdrawal

-

Withdrawals are made by bank transfer or to a debit card if a bank account is linked to the account.

-

The withdrawal request is processed by the financial department of the company within 5 working days.

-

Withdrawals to Public are free, but the receiving bank may charge a fee for processing and making a payment.

-

You can withdraw money from a trading account only after going through the Know Your Customer (KYC) procedure.

Investment Options

Public offers a wide range of stocks and ETFs for investment with the option of fractional purchases for any amount the client has. The assets do not include OTC shares, as investing in them is associated with increased financial risks.

Public investing is the key focus of Public

The algorithm at Public is based on public investment. This means that each registered user can view the profiles of other clients of the company. Thus, novice investors can learn the composition of the portfolios of successful traders, as well as find out what assets and strategies experienced community members use to buy and sell. It is also possible to get advice and comments on your own operations. See, for example, the basic principles of public investing with public.com:

-

To take part in the discussion of the current situation on the stock market, share your opinion and review the opinions of other investors, and you can join an active chat on a topic of interest or open your own.

-

The functionality of the application makes it possible to save messages for later viewing, as well as block or add to the blacklist a specific person or unwanted content.

-

Sorting channels by trends and chronology is available in the application settings.

-

For a quick search for a ready-made solution in the Union the "List of Celebrities" is presented. It includes traders whose investment strategies are most popular with subscribers.

-

You can chat, view profiles, and use the built-in training functions while trading.

-

If the client wants to restrict access to his profile, then he can install the private trading function.

Persons under the age of 18 can create an account to view other users' profiles and participate in chats. However, they can open their own account for trading only after they reach the age of majority.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Public’s affiliate program:

-

Free Stock Slices is a customer attraction program. The broker provides the opportunity to choose one share, after which its shares of up to $70 are randomly distributed between the client and the referral. It is allowed to sell the received assets no earlier than 3 months after their receipt.

To participate in the program, you must submit an application and receive a special promotional code. One client can receive a reward of up to $500. The money is paid out only after the new investor passes the verification procedure and replenishes the deposit.

Customer support

Customer Service Representatives are available to assist customers on weekdays from 9:00 am to 5:00 pm Eastern Time (EST).

Advantages

- To contact by email, an automatic transition from the site to the services of free postal services is carried out

- Online chat works during business hours

- The site has a FAQs section

- You can contact the company management directly

Disadvantages

- No 24/7 support

- You cannot order a callback

- There are no ready-made contact forms on the site

- Online support chat is only available in the app

There are several ways to contact support:

-

Send email;

-

make a phone call;

-

contact via chat in the mobile application.

The company has accounts in popular social networks such as Facebook, Twitter, Instagram, andLinkedIn, where you can also get answers to your questions.

Contacts

| Registration address | 1 State Street Plaza 10th Floor, New York, NY 10004 |

|---|---|

| Regulation | FINRA, SIPC |

| Official site | https://public.com/ |

| Contacts |

Education

Public does not offer training for novice traders, but the company's website has a Learn section where you can get information from successful investors, as well as learn about the specifics of working with a broker.

The Learn section also provides up-to-date market information that can help professional traders expand their stock exchange experience.

Detailed Review of Public

Public is licensed and regulated by FINRA. The broker operates under the motto "Investors are all", therefore, it offers for trading the most easy-to-use mobile application with an interface that is understandable even for novice investors. Connecting to a social trading platform enables traders to share their knowledge, get advice from the pros and view their profiles to learn profitable strategies.

Exclusive offers from Public:

-

A social network that makes trading on the stock exchange understandable for everyone.

-

Registration of minors is subject to the use of the application to learn the market.

-

Purchase of fractional shares for any amount, starting from USD 1.

-

Increased account security and additional insurance policy from the clearing company.

Public is a broker that makes investments available to clients of any experience level and capital size

From February 21, 2021, the broker refused to receive income in the form of payment for the flow of orders, since when they are transferred to the market maker, the client cannot see how profitable the execution price is for him. At the moment, to avoid a conflict of interest with clients, Public sends their orders directly to the exchange, which guarantees the transparency of the execution of each order. The company receives interest income on cash balances and from tips, so the abandonment of market makers did not affect the value of shares for customers. To reduce financial risks, the broker does not offer for investment Penny stocks and OTC stocks, which have low liquidity.

For investing and trading, Public offers a mobile application that runs on OC iOS and Android. The application provides access to trading, Traders Union and the client's account. Convenient functionality without any frills allows you to carry out the process of buying and selling assets in one click. Access is protected by two-factor authentication and 128-bit AES encryption. Additionally, you can secure the login to your account by connecting the biometric identity recognition function.

Useful services of Public investment:

-

Drop-in Audio. A function that allows you to connect to the broadcast of the speeches of leading traders online. Before the conversation starts, the "Public Live" button appears in the application, with which you can join the webinar.

-

Long-Term Portfolio. Allows you to transfer assets to a long-term investment portfolio. If a client mistakenly decides to sell these shares, the system will warn about his long-term investment intentions.

-

Tags. Option to add tags that will later be used to search for articles or contacts in the community.

-

Verified Badge. A verified user badge proves to investors who are interested in a trader's portfolio or strategy that they can see a genuine account. To obtain such a badge, you need to fill out the form on the website and go through a certain validity check.

Advantages:

Regulation and control of activities by FINRA and SIPC.

The ability to invest in securities even without the necessary experience.

100% nonexistence of brokerage and non-trading commissions.

Free deposit and withdrawal of funds.

Easy to use mobile app.

Free access to the social community for public trading.

High level of account security.

To gain experience in the stock market, the Public broker provides the opportunity to register an inactive account, even for persons under the age of majority.

Latest Public News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i